Lease vs Buy in California: Why Smart Californians Lease in an Uncertain Market

Written By

Peter C. Smith

Published

Feb 16, 2026

California car buyers face a fundamentally different vehicle landscape than even ten years ago: more complexity, more tech, more potential repair exposure, and rapidly evolving depreciation dynamics.

In this environment, leasing is not just a payment strategy — for many busy professionals and dual-income households, it’s a risk-management and optionality strategy. When structured correctly, leasing delivers budget predictability without locking you into long-term financial exposure.

This article explains why smart Californians lease, when it makes sense — and when it doesn’t — while tying those insights to real-world decisions and your vehicle goals.

1. How Modern Vehicles Changed the Math

Vehicles today are dramatically more complex than they were even 10–15 years ago. Beyond traditional mechanical parts, modern cars now include layers of software, sensors, and advanced driver-assistance systems that:

Increase repair complexity and labor costs

Expand the range of potential failure points

Demand specialized diagnostics and tools

This means out-of-warranty repairs are more expensive and unpredictable. A task that once cost a few hundred dollars — like a tail lamp — can now include sensors or radar hardware and cost thousands.

Couple that with tighter packaging in modern engine bays, sophisticated multi-gear transmissions, and turbocharged engines running at higher stresses, and you have a larger range of expensive failure modes. Predicting ownership cost with precision becomes harder.

This context sets the stage for understanding optionality and risk transfer, especially as households balance time, budget, and uncertainty.

2. What Leasing Actually Does: Optionality and Predictability

Leasing is fundamentally a form of optional ownership:

You pay only for the portion of the vehicle you use

You stay under the manufacturer’s bumper-to-bumper warranty

You avoid long-term depreciation risk and major repairs

This structure is inherently different than traditional ownership through a long loan, where you are fully exposed to market depreciation and repair costs once warranties expire.

When you lease, you preserve flexibility:

You can return the vehicle at lease end

You can upgrade or modify your vehicle sooner

You avoid being “upside down” when life circumstances change

It’s similar to having the right, but not the obligation to own the vehicle at a future price, with the residual value set upfront, reducing unpredictable outcomes.

3. California’s Unique Tax Environment — Why It Matters

California’s high sales tax environment creates another structural factor in lease decisions:

Buying a vehicle triggers tax on the entire purchase price

Leasing taxes only the portion you actually use — the monthly payment portion

This means if you change vehicles every 3–4 years, leasing can reduce your cumulative tax burden compared with purchasing and trading repeatedly.

This tax nuance is a distinct California advantage for leasing that many buyers overlook.

4. When Leasing Makes Sense in California

Leasing tends to be especially compelling when several conditions align:

You value predictable monthly costs

You prefer staying under warranty for most of the term

You plan to change vehicles every 3–5 years

You aim to manage risk (depreciation, repair inflation)

You live in a high-tax state like California

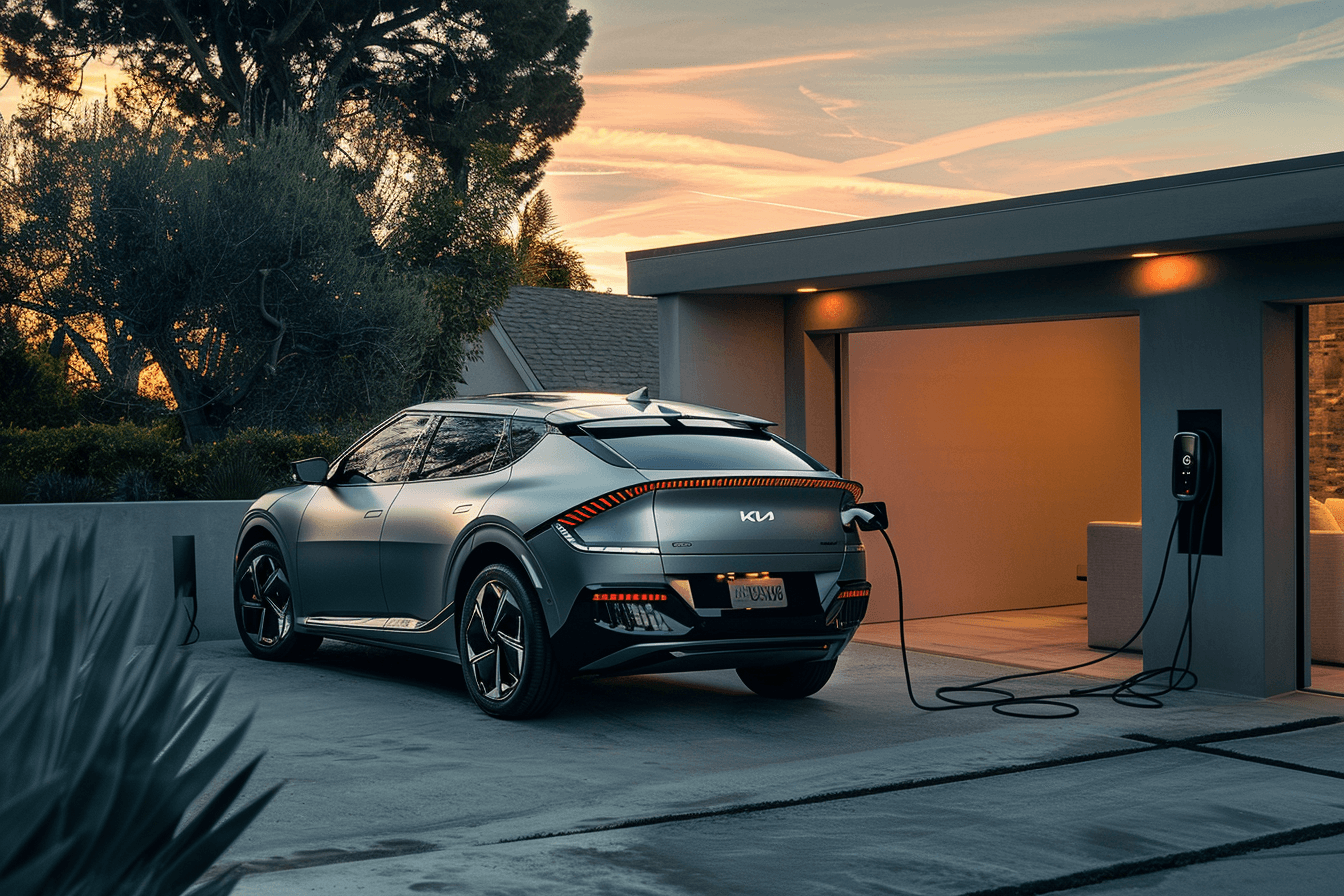

Leasing also plays well with more volatile segments of the market — especially electric vehicles — because it transfers much of the depreciation risk associated with rapid technology changes to the lender.

For a deeper dive into structuring leases and understanding current programs, see our Explore CarOracle’s Auto Leasing Program

5. When Leasing May Not Make Sense

Leasing is not always superior. It may not be the best fit if:

You tend to keep vehicles for 8–10+ years

You drive very high annual mileage

You strongly prefer long-term ownership

You want to build equity or sell later

If these conditions align with your situation, purchasing may still be the right choice — and our Auto Buying Program explained is tailored to help you evaluate that with precision.

6. Choosing the Right Strategy: Leasing, Buying, or Something In-Between

Vehicles aren’t all the same, and neither are lease programs.

Some manufacturers deliver strong lease structures with high residuals and attractive incentives. Others offer purchase programs that may be more favorable. It’s about evaluating each opportunity with context, not assuming one approach always wins.

For help understanding different approaches in California — including how to choose between services and auto broker models — see our 2026 Guide to California Auto Buying Services and How to Choose an Auto Broker.

7. Smart End-of-Lease Planning

Leasing isn’t just about the term — it’s also about the end:

You can return the vehicle

You can extend the lease

You can purchase the vehicle

You can explore manufacturer pull-ahead incentives

End-of-lease decisions are nuanced and can affect your next step. For more detail, check our article on Understanding Your Lease‑End Options in California.

Conclusion

There is no one-size-fits-all answer on whether leasing is better than buying. But in California’s complex tax, tech, and depreciation environment, leasing delivers a unique combination of optionality, budget predictability, and risk management that many busy professionals find appealing.

If you want help interpreting your situation and aligning your acquisition strategy with your goals — whether that’s leasing, buying, or a hybrid approach — our consultative process is designed precisely for that.

Whether you’re evaluating incentives, residuals, manufacturer programs, or sales tax effects, a thoughtful strategy beats a default.

Frequently Asked Questions: Lease vs Buy in California

Is it better to lease or buy a car in California?

There is no universal answer. Leasing can offer more flexibility and predictable costs, especially in California’s high-tax environment and rapidly evolving vehicle market. Buying may make more sense if you plan to keep the vehicle for 8–10 years or longer. The right decision depends on your ownership timeline, mileage, and tolerance for long-term repair risk.

Why do many Californians choose to lease instead of buy?

Many California drivers lease because it provides optionality. A lease allows you to return the vehicle at the end of the term instead of being locked into long loan commitments or facing negative equity if your needs change. Leasing also keeps most drivers under the manufacturer’s warranty for the majority of the term.

How does California sales tax affect leasing vs buying?

When you buy a car in California, you pay sales tax on the full purchase price upfront. When you lease, you pay sales tax only on the monthly payment portion rather than the full MSRP. For drivers who change vehicles every few years, this structure can reduce cumulative tax exposure.

Does leasing protect against depreciation?

Leasing shifts much of the depreciation risk to the lender because the residual value is predetermined at the start of the contract. If the market softens or resale values drop unexpectedly, the leasing company absorbs that risk — not you.

Are modern cars more expensive to repair than older vehicles?

In many cases, yes. Today’s vehicles include advanced electronics, sensors, turbocharged engines, multi-speed transmissions, and integrated safety systems. These components increase repair complexity and labor costs, especially once the vehicle is out of warranty. Leasing limits exposure to these long-term repair risks.

When does leasing make the most sense in California?

Leasing often makes sense if:

You value predictable monthly expenses

You prefer driving newer vehicles every 3–5 years

You want to stay under factory warranty

You live in a high sales tax state like California

You want flexibility in case your lifestyle changes

When is buying a car the better option?

Buying may be the better choice if:

You plan to keep the vehicle long term

You drive high annual mileage

You prefer ownership regardless of financial structure

The manufacturer offers strong purchase incentives compared to lease programs

Is leasing a good strategy for electric vehicles in California?

Leasing can be particularly attractive for electric vehicles because EV technology and pricing are evolving rapidly. Leasing helps protect against unexpected resale value shifts tied to technology improvements, battery advancements, or manufacturer price changes.

Can you negotiate a car lease in California?

Yes. Lease terms such as selling price, money factor, and incentives can often be negotiated. Understanding how a lease is structured is critical to determining whether it represents good value.

How do I decide between leasing and buying?

Start by evaluating how long you plan to keep the vehicle, your annual mileage, your repair risk tolerance, and whether flexibility matters to you. A consultative approach — rather than defaulting to one option — typically produces the best outcome.